Chapters

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

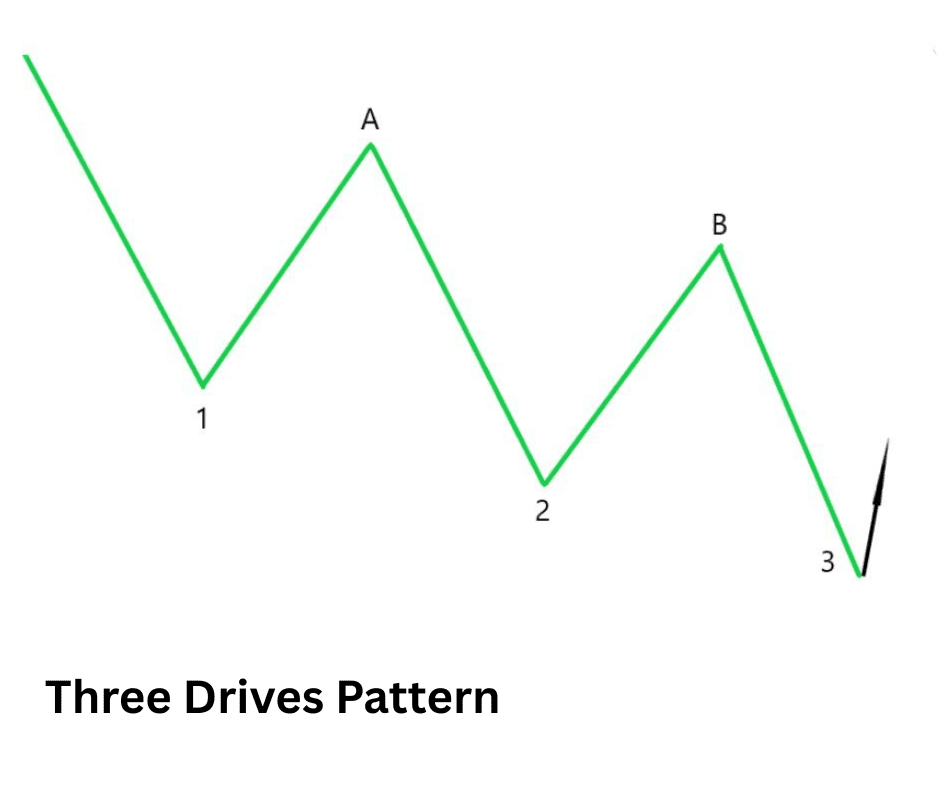

The Three Drives Pattern in Crypto Trading

Amid all the usual chaos of crypto markets, certain price patterns can give you an edge – a glimpse into what the crowd might do next.

One of those is the Three Drives pattern. It’s not as hyped as triangles or head-and-shoulders setups, but traders who understand it often treat it like a secret weapon. It’s a harmonic pattern that helps you anticipate when a strong move is about to reverse, whether that’s a bullish rally running out of steam or a bearish drop getting ready to bounce.

Let’s break it down: what it is, how to spot it, what makes it worth using (and what doesn’t), and how you can actually trade it effectively in crypto.

What Is a Three Drives Pattern

The Three Drives pattern is a reversal formation based on symmetry and Fibonacci ratios. It was first recognized in traditional markets but applies just as well, maybe even better in crypto, where emotions and volatility often exaggerate market moves.

At its core, the pattern represents a market that’s pushing too far, too fast, and about to snap back. It consists of three consecutive price drives in the same direction, each completing a final “push” before the trend reverses.

Think of it as the market taking three deep breaths before exhaling in the opposite direction.

In a Three Drives to the Top pattern (bearish setup), price makes three higher highs: each one smaller in momentum or taking longer to form, signaling exhaustion in the uptrend.

In a Three Drives to the Bottom pattern (bullish setup), price makes three lower lows with similar characteristics, showing sellers are running out of gas.

It’s a visual story of momentum fading out.

How to Identify It

The Three Drives pattern isn’t a simple “spot three highs and call it a day” deal. It’s precise, which is what makes it powerful. You’re looking for symmetry in both time and price.

Here’s what defines it:

1. Three consecutive drives

Each “drive” is a clear impulse move followed by a retracement. The market creates three similar swings, up or down, that usually align with Fibonacci extensions.

Drive 1 → Retracement A-B

Drive 2 → Retracement B-C

Drive 3 → Completion point (potential reversal zone)

2. Fibonacci harmony

This pattern lives and dies by Fibonacci.

Each retracement (A-B and B-C) often pulls back to the 0.618 or 0.786 level of the previous drive.

Each drive often extends to the 1.272 or 1.618 Fibonacci extension of its preceding retracement.

That repeating ratio structure gives it a geometric rhythm; it’s what separates a true Three Drives setup from random price noise.

3. Time symmetry

Each drive usually takes about the same amount of time to form. If Drive 1 took a day to complete, Drives 2 and 3 should roughly do the same. Perfect symmetry is rare in crypto, but close is good enough; it’s the pattern’s rhythm that matters.

4. Momentum divergence

This is your final confirmation. While the price keeps making new highs (or lows), momentum indicators like RSI or MACD usually tell a different story, weakening with each new drive. That’s your cue that the trend’s energy is fading.

Quick visual recap:

- Drive 1: Strong move

- Retrace A-B: Pullback (~0.618–0.786)

- Drive 2: Push continuation (~1.272–1.618 extension)

- Retrace B-C: Another pullback

- Drive 3: Final push (usually with divergence)

- Reversal zone: Time to prepare for the opposite move

Pros and Cons of the Three Drives Pattern

Pros

- Early reversal signal: It often spots trend exhaustion before the majority catches on.

- Clear structure: Its Fibonacci framework keeps your analysis objective and rules-based.

- High reward potential: When it plays out, the reversals are often sharp and profitable.

- Works across time frames: You’ll find it on 15-minute charts and weekly charts alike.

Cons

- Requires patience: You need all three drives to complete, and in fast crypto markets, that can take time.

- Precision-dependent: Misjudging one leg can throw the entire pattern off.

- False signals: Sometimes a market looks like it’s forming the pattern, then blows right through the “reversal” point and keeps trending.

- Subjectivity: While Fibonacci levels are mathematical, traders still have to interpret which swings count, and not everyone sees the same thing.

Bottom line: it’s not a magic bullet, but in the hands of a disciplined trader, it’s a weapon.

How to Interpret the Three Drives Pattern

So you’ve spotted three drives on the chart, now what?

Here’s how to think about it step by step:

-

Recognize exhaustion.

The third drive is the market’s last attempt to keep the trend alive. The structure signals “buyers (or sellers) are getting tired.” -

Wait for confirmation.

Don’t jump in at the exact top or bottom; that’s guessing, not trading. Wait for signs like a break of the minor trend line, a reversal candlestick (like a pin bar or engulfing pattern), or volume divergence. -

Measure the reversal zone.

The sweet spot is around the 1.272–1.618 extension of the final retracement. This zone is where the pattern “completes,” and you expect a change in direction. - Plan your entry and exit.

Entry: After confirmation (e.g., candle close beyond local structure).

Stop loss: Just beyond the extreme of the third drive, the market shouldn’t revisit that level if the reversal is valid.

Take profit: You can aim for Fibonacci retracement targets (like 0.382 or 0.618 of the entire move) or major structure levels.

Think of it as catching the reversal, not the knife.

Examples of Trading the Three Drives in Crypto

Let’s put this into context with two strategy setups: one bullish, one bearish.

Example 1: Bullish Three Drives on Bitcoin

Imagine BTC is in a downtrend. You spot three distinct legs down:

Drive 1: Drops from $60K to $56K.

Retrace A-B: Pulls back to $58K (~0.618 retrace).

Drive 2: Falls to $54K (~1.272 extension).

Retrace B-C: Bounces to $56K again.

Drive 3: Final push to $52.5K (~1.618 extension) with RSI divergence (lower lows in price, higher lows in RSI).

That’s your bullish Three Drives setup. Once price breaks above the short-term trendline connecting the highs of the retracements, you enter long.

- Stop loss: Below $52K.

- Take profit: $56K (first target), $60K (second target).

Even if you hit just the first target, you’ve caught a reversal before most traders even realize it’s starting.

Example 2: Bearish Three Drives on Ethereum

ETH rallies from $1,800 to $2,200, pulling back modestly between each push. You measure the extensions and retracements: they line up beautifully with Fibonacci harmony. RSI shows weakening momentum.

On the third drive (to around $2,300), price stalls, forms a shooting star candle, and volume drops off.

You go short after the breakdown from the small rising trendline.

- Stop loss: Above $2,320.

- Take profit: $2,150 and $2,000.

That’s how you turn a pattern into a plan: clear structure, clear risk management.

Three Drives Strategies for Crypto Traders

Here are some practical ways to integrate this pattern into your trading playbook:

1. Combine it with RSI or MACD divergence

The Three Drives pattern works best when it’s backed by clear momentum divergence. If the price makes a higher high while RSI makes a lower high, that’s your green light.

2. Watch for confluence

Stacking signals increases your odds. Look for the pattern forming near:

- Key support/resistance levels

- Trend line boundaries

- Supply/demand zones

- Fibonacci clusters

When those align, the probability of reversal skyrockets.

3. Use multiple time frames

Spot the Three Drives on a higher time frame (like 4H or daily), then zoom in to lower time frames (like 1H) for precision entries.

4. Set alerts instead of staring at charts

Crypto trades 24/7 but you don’t have to. Use alerts for when price hits your Fibonacci extension zones, so you can check for confirmation without burning yourself out.

5. Risk management comes first

Even though the setup can be reliable, always manage position size properly. A clean Three Drives pattern can fail if a sudden catalyst (like ETF news or a whale dump) hits the market.

Key Takeaways

The Three Drives pattern won’t turn you into a market wizard overnight, but it gives you something most traders never bother to look for: structure inside the chaos. When you know how to read those three pushes, you start spotting exhaustion before the herd notices anything is wrong. You stop guessing tops and bottoms and start timing reversals with intention.

It rewards patience, discipline, and clear rules. It punishes shortcuts. That’s why it works so well in crypto, where the crowd is usually rushing in blind.

Master the symmetry, respect the Fibonacci levels, wait for confirmation, and manage your risk like it matters. Do that, and the Three Drives pattern becomes more than a chart formation. It becomes a way to stay ahead while everyone else chases noise.