Chapters

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

.svg)

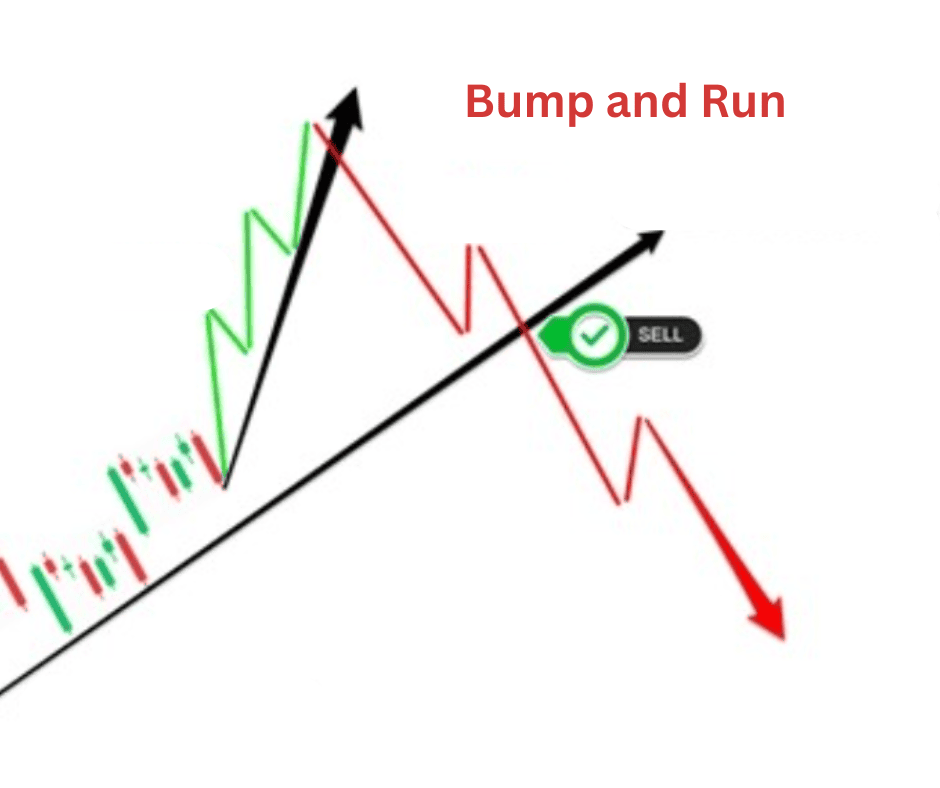

The Bump and Run Pattern in Crypto Trading

You’ve seen it happen: a coin grinds higher at a steady pace, then suddenly goes vertical as FOMO kicks in. Everyone screams “moonshot,” but just as quickly, the pump fizzles and the chart caves in.

That move is a classic bump and run pattern, and if you can spot it early, it can save you from bag-holding or set you up for a killer trade.

Learn more below about one of the lesser-known but powerful chart patterns, often just called the bump and run.

What Is the Bump and Run Pattern?

Originally described by technical analyst Thomas Bulkowski, this pattern signals when an overextended price move driven by hype, FOMO, or straight-up mania, runs out of steam and reverses.

In plain English: it’s the market saying, “This pump has gone too far, time to flip the script.”

The bump and run is all about extremes. It starts with a gradual climb, suddenly spikes into an unsustainable rally (the “bump”), then crashes back through trend support and reverses (the “run”). When you spot it, it can give you a clean entry for shorting or a heads-up to exit before the floor caves in.

How to Identify the Bump and Run

The bump and run has three distinct phases. If you know what to look for, it’s surprisingly recognizable on a crypto chart:

1. The Lead-In Phase

What happens: Price rises steadily at a moderate angle, usually 30–45 degrees.

Why it matters: This is normal accumulation. Nothing too crazy, but it sets the baseline trend line you’ll need later.

What to do: Draw a trend line under the lows of this steady climb. This line will eventually become the “support line” price breaks during the run.

2. The Bump

What happens: Out of nowhere, price explodes upward at a much steeper angle—often double the slope of the lead-in. Think parabolic moves, meme coin pumps, or Bitcoin going vertical during a hype cycle.

Why it matters: This is where irrational exuberance kicks in. Volume spikes. FOMO traders pile in. Everyone screams “to the moon.”

What to do: Don’t chase. Instead, mark the bump’s peak and note how steep the climb is. This sharp rise is unsustainable.

3. The Run (a.k.a. the Reversal)

What happens: Price tops out, stalls, and then falls back toward the original trend line. The pattern is confirmed once it breaks below that line with volume.

Why it matters: That breakdown is your signal. The fun’s over, and the move is reversing.

What to do: Enter short positions, scale out of longs, or set stop losses if you’re still holding. The decline can be sharp and brutal.

Quick Checklist for Spotting It

- Lead-in: moderate slope with steady volume.

- Bump: price accelerates dramatically, slope doubles or more.

- Peak: high volume, euphoria, wicks on candles.

- Run: breakdown through the trendline with conviction.

If you see these lined up, you’ve likely spotted a bump and run.

Pros and Cons of the Bump and Run Pattern

Like every tool in technical analysis, the bump and run isn’t magic. Let’s break down its strengths and weaknesses.

Pros

- Clear structure: The three phases make it easier to identify compared to fuzzier patterns.

- Reliable reversal signal: Bulkowski’s research shows a decent win rate, especially on daily charts.

- Works on crypto: Because crypto markets are hype-driven, bump and runs appear more often here than in traditional stocks.

- Risk management friendly: Once the support line breaks, you have a defined invalidation point for stops.

Cons

- Timing is tricky: You can’t know a bump is complete until after the peak. Enter too early, and you might get wrecked.

- False signals: Some parabolic moves consolidate instead of reversing. Spotting the difference isn’t always easy.

- Best on larger time frames: On lower time frames, noise and volatility create fake bumps that don’t play out.

- Requires patience: You might watch the lead-in and bump for weeks before the run finally happens.

In short, it’s a strong pattern but not bulletproof. Combine it with volume, sentiment, and risk management.

How to Interpret It

Think of the bump and run as a story about trader psychology:

- Lead-in: Rational buying. Investors see value.

- Bump: Irrational greed. Latecomers jump in. Price disconnects from reality.

- Run: Reality check. Smart money exits, bagholders panic, price collapses.

Interpreting it this way keeps you from being one of the bagholders. You don’t want to buy in the bump. You want to wait for the run.

Also, remember that bump and run is primarily a bearish reversal pattern. There is a bullish version (downtrend followed by a sharp drop, then reversal up), but in crypto, the bearish version is far more common and useful.

Crypto Trading Strategies Using the Bump and Run

Let’s put theory into practice. Here are some ways traders use the bump and run:

1. Shorting After the Breakdown

Setup: Wait for price to pierce the lead-in trendline on strong volume.

Entry: Short immediately after confirmation.

Stop loss: Just above the last minor peak.

Target: Use Fibonacci retracements (0.5–0.618) or previous support zones.

Why it works: Momentum shifts drastically once the trend line breaks.

Example: Suppose Ethereum climbs steadily from $1,500 to $2,000 (lead-in), spikes to $2,600 in a week (bump), then drops back under the $2,000 trendline (run). A short entry here could ride ETH back to $1,700 or lower.

2. Exiting Longs Early

Setup: You’ve been holding a coin through a healthy uptrend. Suddenly it goes parabolic.

Action: Instead of celebrating, you recognize the bump forming and secure profits before the run starts.

Why it works: Selling into strength avoids becoming exit liquidity when the crash comes.

Example: DOGE rockets 200% in a week after Elon tweets. Smart traders see the bump and sell. Others hold “for the memes” and get trapped in the run.

3. Swing Trading the Retest

Setup: After breaking the trendline, price often retests it from below.

Entry: Short the retest with tight stops.

Why it works: Failed retests confirm the breakdown and give a safer entry.

Example: BTC crashes through the lead-in support at $40k, bounces back up to test it, then rejects. That’s your high-probability short.

4. Pairing With Volume and Sentiment

Setup: Watch for bump phases accompanied by meme hype, Twitter euphoria, or TikTok traders calling for 10x.

Action: Use that sentiment spike as extra confirmation the bump is unsustainable.

Why it works: Hype always fades, and bump and run thrives on fading hype.

5. Defensive Use in Portfolio Management

Even if you’re not actively trading, spotting a bump and run on a coin you hold can tell you when to trim or hedge. Instead of watching your gains evaporate, you act proactively.

Bottom Line

The bump and run isn’t the most famous crypto pattern, but it deserves a spot in your trading toolbox. It captures the emotional cycle of markets better than most: rational rise, irrational spike, brutal reversal.

Here’s the takeaway:

- Don’t chase the bump.

- Mark your lead-in trendlines early.

- Wait for confirmation before acting.

- Use it with volume, sentiment, and solid risk management.

Crypto loves extremes, and the bump and run thrives in extremes. Learn to recognize it, and you’ll spot opportunities where others only see chaos.